In the dynamic world of professional tennis and the ever-evolving landscape of venture capital investment, the ability to make decisions under uncertain conditions is paramount. Both areas require a strategic mindset, a keen understanding of risk-return trade-offs, and the ability to adapt in real-time.

This analysis aims to highlight the parallels between tennis and venture capital investment, and to inspire investors and founders to embrace the principles that have shaped our investment strategies at Crosscourt VC and Qualcomm Ventures.

Origins of the Analysis

This exploration was sparked by a recent social lunch we had in San Diego. We were discussing the meaning behind the tennis-inspired name, Crosscourt.vc. The conversation delved into the intriguing parallels between tennis and venture capital investments, drawing from our experience working with startups.

For context, Francesco Favaro is a co-founder of Crosscourt, a VC firm investing in early-stage technology startups at the intersection of physical and digital. The name “Crosscourt” refers to the tennis shot players use to set up a winner – analogous to how Crosscourt VC aims to enable founders to be set up for success. Albert Wang is from Qualcomm Ventures, which is a $2B corporate venture fund investing in technology startups across all stages. He brings both perspectives to the table as both an investor and a tennis player who also coaches his high school twin boys on competitive tennis.

Through further discussion, we realized that these parallels weren’t just casual observations, but rather profound insights that could benefit both founders and investors in their respective journeys. We decided to collaborate on this piece to share our unique perspectives. What follows is our analysis of how the principles that govern success in tennis mirror the critical elements of successful venture investing, and the practical lessons we’ve learned from both arenas.

Embracing Uncertainty Through a Probabilistic Mindset

The Philosophy of Probability and Failure

At its core, success in both tennis and venture capital requires embracing uncertainty as an inherent part of the game. A probabilistic mindset acknowledges that while specific outcomes may be uncertain, we can characterize the probability distribution of various possible outcomes to bring a degree of statistical certainty to our decision-making.

This philosophy also recognizes that failures are inevitable in any challenging pursuit. The key isn’t to avoid failure but to learn from it and adjust. Success comes from compartmentalizing failures, understanding their impact on overall outcomes, and maintaining a growth mentality that drives continuous improvement despite inevitable setbacks.

The Power of Statistics in Both Worlds

In tennis, the probabilistic nature of the game is striking. Take Roger Federer’s career statistics: in 1,526 singles matches, he won an impressive 80% of his matches – yet he only won 54% of individual points. (https://www.youtube.com/watch?v=_ILk8Yai3Wo) Rather than playing conservatively, Federer embraced these statistics, taking calculated risks often on break points, understanding that without risk, there could be no reward.

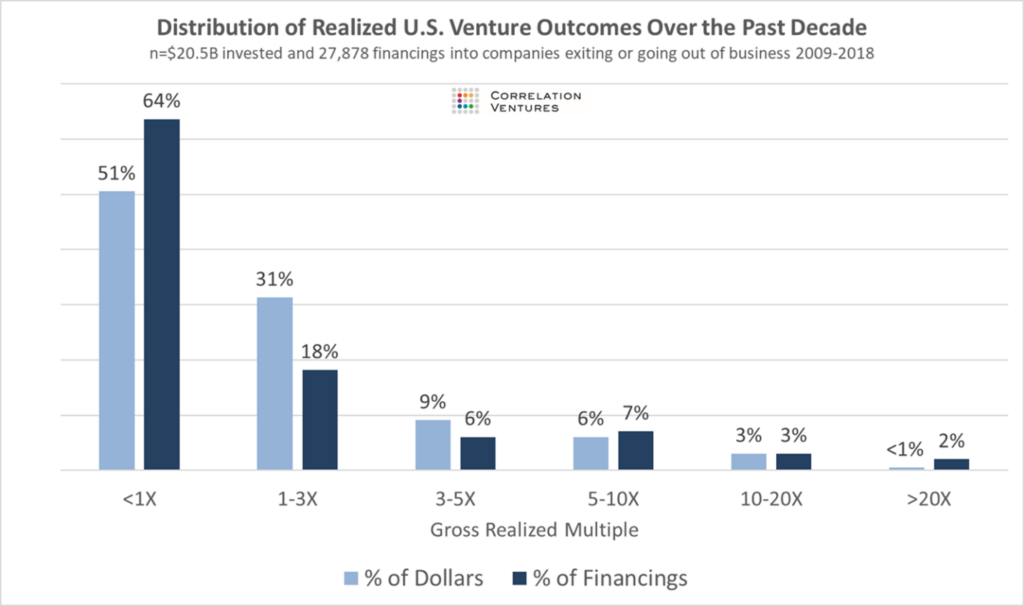

Similarly, venture capital returns typically follow a power law distribution. Most startup investments return less than the invested capital – a sobering statistic that shows VCs get it wrong more often than right. Yet, like tennis players going for winning shots, VCs continue to swing their “investment racquets” because when they succeed, the returns substantially outweigh the losses.

At Crosscourt VC, this principle translates into efficient deal evaluation through the rapid assessment of numerous opportunities, focusing on key drivers that typically account for most of an investment’s potential outcome. Contrary to what many might expect, rapid decision-making does not necessarily compromise portfolio performance. In fact, speed is essential to capturing valuable opportunities.

Just as a tennis player who never swings will never hit a winner, an investor who moves too slowly risks missing potentially transformative investments. The key is developing the ability to make swift, informed decisions rather than seeking perfect information at the cost of missing the opportunity entirely.

At Qualcomm Ventures, analysis revealed that many of their best investments didn’t necessarily have team consensus, highlighting the importance of maintaining an investment allocation for non-consensus deals to capture potential outliers. Like a tennis player who doesn’t need to win every point to win the match, a venture portfolio doesn’t need every investment to be a unanimous decision to generate outstanding returns. The key is having the conviction to take calculated risks while managing position sizes to ensure that when these contrarian bets pay off, they can meaningfully impact overall portfolio returns.

Source: Correlation Ventures

Taking a Systematic Approach to Maximizing Outcomes

The Philosophy of Systematic Decision-Making

Success in both tennis and VC investments requires a three-tiered systematic approach: thoughtful planning at the strategic level based on a solid understanding of strengths, weaknesses, opportunities, and threats; quick and sound decision-making at the tactical level through understanding risk-reward trade-offs; and consistent execution at the technical level enabled by swift adaptive positioning that minimizes variations.

This systematic framework helps ensure that decisions are made with clear intention and purpose, rather than reactive impulses or gut feelings. It helps allow practitioners to navigate uncertainty while maintaining a coherent approach to achieving their goals.

Strategic Level: Playing to Your Strengths

In tennis, players must understand their style – whether they’re baseliners, volleyers, or all-court players – and develop appropriate strategies. The playbook for developing points becomes crucial: playing with the closing shot in mind, accounting for how the rally will be set up (cross-court shots are great!), applying pressure through approach shots and angles, and closing the points effectively with step-in and volley.

Similarly, VC funds need to account for their individual areas of strengths and styles of investment, including stages (early stage, growth stage, or stage-agnostic) and sector specificity. Furthermore, VCs must account for their strategies across the investment lifecycle including deal sourcing, access, structuring and starting with the exit in mind.

Crosscourt plays to its strengths by focusing on applying technology to physical world challenges, leveraging deep industry knowledge and networks for faster, more informed evaluation and adding value to portfolio companies after completing the investment.

Qualcomm Ventures prioritizes investments where they can provide unique value through connections to Qualcomm Incorporated’s business groups, portfolio companies, or industry network engagements. Not only do these opportunities represent lower investment risk due to more intimate domain knowledge, but they also allow Qualcomm Ventures to affect positive changes to fast growing startups with unique resources mobilized through the network such as go to market guidance, technology roadmap insights, or strategic collaboration.

Tactical Level: Risk-Return Trade-offs

During the execution of a point, tennis players have to contend with significant variability. Shot selection depends on both players’ position, the type of shots received as well as environmental variables such as weather, shadows, and the freshness of the tennis ball. This is when a player’s ability to make real time risk-return trade off decisions between safe shots and aggressive shots can make a difference.

Similarly, in portfolio construction, VCs need to consider the risk-return trade off of individual investments, accounting for individual deal parameters and the stage of industry cycles. It is not uncommon for a VC to be presented with a unique opportunity created by a market dislocation that requires the VC to take a calculated risk. Investing within the “Circle of Competence” is often an embraced approach to manage such risks.

Crosscourt calibrates its investment approach based on market dynamics and company positioning, taking smaller positions across several promising players in fragmented markets while concentrating investments in winner-take-most sectors.

Qualcomm Ventures considers investments in the context of platform cycles, placing heavier bets in the foundational layers of the industry stack in the earlier days, then moving up through the orchestration layers to the application layers as the platform matures over time.

Technical Level: Positioning and Execution

In tennis, positioning and footwork often matter more than swing technique itself. Players must quickly move to the correct position as it allows the players to rely on their lower body and footwork to maintain proper upper body posture, producing more reliable shots. Additionally, players should aim to deliver shots with a good margin of error, prioritizing consistency over unnecessary risks. When players find themselves out of position, they should focus on hitting defensive reset shots to regain control and get back into the rally.

VCs similarly must prioritize discipline in investment execution and resist temptations of making one-off exceptions for certain deals. When venturing into new territories, they might take smaller positions or invest as part of a syndicate to learn the space while managing risk. Both Crosscourt and Qualcomm Ventures follow these principles in their investment approach.

Upleveling the Game Through Teamwork & Technology

The Philosophy of Collective Excellence

In fields that largely attribute success and failure to individual performance, teamwork and technology are often overlooked levers that can significantly uplevel the game. This philosophy recognizes that teamwork increases the learning surface area, allowing collective wisdom to lead to more holistic decision-making. Technology enables unprecedented data collection, insights, and predictions that ground decisions in science rather than hunches.

While both tennis and venture capital might appear as individual pursuits, success often depends on strong team support and technological advancement.

Tennis players are often alone on court. But behind every champion is a dedicated team that hones their physical and mental game. AI and data analytics have also revolutionized tennis training approaches. Craig O’Shannessy, who once worked with Novak Djokovic as his coach, revealed that while 90% of practice focused on long rallies, only 10% of match points involved rallies longer than 9 shots – insights that transformed training methods to focus on closing points faster.

In venture capital, investors collaborate with other partners in the firm, with company founders, co-investors, and industry experts to drive portfolio companies toward success. VC firms also increasingly leverage AI for deal sourcing and decision-making. For example, Qualcomm Ventures has developed AI models trained on data from tens of thousands of startups to predict investment success probability, offering insights beyond human capability. Similarly, Crosscourt leverages AI for due diligence.

Conclusion

The parallels between tennis and venture capital investment run deep, offering valuable lessons for practitioners in both fields. Tennis players can benefit from applying investment thinking on the court, while investors can draw inspiration from their experiences on the tennis court. Both domains reward those who embrace uncertainty, take calculated risks, and maintain a systematic approach to decision-making.

The philosophical foundations of embracing uncertainty, taking a systematic approach, and leveraging collective wisdom through teamwork and technology provide a framework for excellence in both domains. Success comes not from avoiding uncertainty but from understanding it, not from eliminating risk but from managing it, and not from individual brilliance alone but from the combination of personal skill, team support, and technological advancement.

Whether you’re a tennis player, an investor, or an entrepreneur, we invite you to share your own experiences. In particular, if you are a startup founder with bold ideas looking for a partner who could help you strategize and execute, or a fellow investor building your portfolio, we’d love to hear how you are approaching your game. How are you navigating risk-reward tradeoffs in your field? What strengths are you playing to, and how are you positioning yourself to win?

Connect with us to join the conversation and share your insights on how principles from different domains can inform and improve our approach to both business and competitive sports. Together, we can continue to explore these fascinating connections and learn from each other’s experiences across the tennis court and in the boardroom.